Understanding Payroll Basics

Payroll can be tough to understand. The employee doesn’t get enough money, the taxes are too high, and nothing seems to balance. Worst of all, even a small mistake can cost thousands of dollars. We are going to show you how payroll works so you can better understand what may be the largest expense for your business.

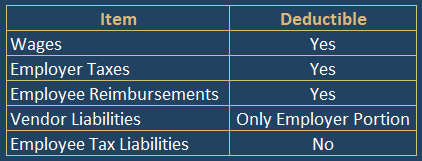

Payroll Expenses and Liabilities

Payroll can be broken down into multiple categories:

Wages. This is the total amount you paid to the employee. This is an expense to the company and can be deducted.

Employer taxes. These are the employer-portions of the payroll taxes, including Social Security tax match, Medicare tax match, federal unemployment tax, and state unemployment tax. Some states may have additional taxes. These are also an expense to the company and can be deducted.

Employee tax liabilities. This refers to the taxes you withheld from the employee. You (personally) and your business have the legal responsibility to pay these taxes on time to the correct government agency on behalf of your employee. These are not deductible because they are part of the wages you paid the employee and would be deducted already.

Vendor liabilities. Examples include deductions from your employee’s paycheck for health insurance and retirement contributions. The business has the responsibility to pay these amounts to the vendors on behalf of the employee. These amounts are not deductible because they are included in the wages of the employee and have already been deducted. However, any match or employer-related expense would be deductible.

Specific expenses via reimbursements. Certain reimbursements to an employee would be deducted as its expense type instead of wages. For example, reimbursing an employee for mileage driven would be considered a vehicle or travel expense instead of a wage expense.

Elements of a Paycheck

Now that we understand the different types of payroll figures that exist, let’s look at where the amounts come from. There are a few key elements of a paycheck to understand. The main elements are as follows:

Gross Wages

Gross wages include salaries, hourly pay, bonuses, commissions, reimbursements in a non-accountable plan, personal use of a company vehicle, and a host of other items as unique as each business. Examples of reimbursements in a non-accountable plan would be a gym membership, a free vacation for the top salesperson, or a monthly stipend for mobile phone use. The employee must be taxed on these amounts because these are different forms of compensation in the IRS’s eyes. Total every element of the employee’s pay and this becomes the total gross wage. This amount will be taxable to most government agencies, though special adjustments may exist. For example, an S-Corp owner who has health insurance paid by the company must be taxed on the amount as if it is wages. However, this amount is not taxed by Social Security tax and Medicare tax if either the owner is the only employee or the company provides health insurance to other non-owner employees.

Deductions

Common deductions that exist include health/dental/vision insurance, retirement contributions, FSA contributions, and many more. Each deduction type has its own rules on how it affects taxes. For example, health insurance lowers the tax calculation for federal withholding, Social Security tax, Medicare tax, and most states’ withholding. A traditional retirement contribution typically lowers only the federal and state withholding. A deduction for purchasing a new uniform generally does not reduce any taxation. It’s important to work with your accountant (reach out to us!) to ensure each deduction is set up properly before going into effect or costly mistakes could be made.

Businesses should consider the taxable benefit of providing Social Security tax and Medicare tax-exempt benefits. For example, providing health insurance is a great benefit to your employees and helps retain talent, yet it is expensive. When an employee has health insurance, the employee’s Social Security tax and Medicare tax is reduced. Since the employer’s tax portion matches the employee’s amount, it is also reduced. This can help offset the cost of the benefit provided.

Reimbursements

Reimbursements are usually expenses to the company that are not wages. An example could be a reimbursement for uniform cleaning and employee paid for or for mileage driven by the employee in his/her personal vehicle. In this case, uniform cleaning could be considered a uniform expense and the mileage reimbursement may be a travel expense. Reimbursements may be fully taxable, partially taxable, or tax-exempt, entirely dependent on the company’s procedures, the type of reimbursement, and the specific situation. As diverse as deductions are, there are likely even more reimbursement types so verifying the taxability of the reimbursement is crucial before providing one.

One important requirement is that the company has an accountable plan. The plan details that an employee will only be reimbursed for the exact expense amount and the expense is ordinary and necessary for the business. If the employee buys office supplies for $12.58, the company would need to reimburse for $12.58 and not $13.00. Additionally, the employee could not be reimbursed for a fee the company wouldn’t normally pay for, say a trampoline for an accounting office (if only!). If either were to occur, the employee would need to be taxed on the full amount. Additionally, the tax would reduce the amount you provided so you may need to pay more than the amount to offset this issue.

Some reimbursements have a limit on what is tax-exempt. An example of this is a mileage reimbursement. Each year, the IRS releases a reimbursement rate allowed for mileage driven. Any reimbursement up to the rate is tax-free and any reimbursement beyond the rate would be taxable. Such a reimbursement also requires additional documentation including where the starting and end points were on the trip, how it was relevant to the business, and that it was not commuting.

Taxes

As mentioned previously, there are two types of taxes: employee liabilities and employer tax expenses.

The employee liabilities include any tax you withheld from an employee’s check. This is often Social Security tax, Medicare tax, federal withholding, state withholding, and any special state or local tax that is required. Employer tax expenses include the business’s matching amount of Social Security tax and Medicare tax, along with federal unemployment tax, state unemployment tax, and any special state or local tax that is required.

It’s important to understand each type of tax as many are confused by the employee amounts. Both the employee and employer taxes are regularly paid at the same time as one lump sum so it’s helpful to realize that the entire payment is not a tax expense but instead a combination of the two.

Net Pay

This is everyone’s favorite part of the paycheck. Once the deductions and taxes are subtracted from the gross pay and any reimbursements are added, the final result will be due to the employee (just in time for Amazon Prime Day). Employees are usually paid via check, direct deposit, or to a debit card. However, they can also be paid by cash and through assets, such as cryptocurrency and farm animals. It’s important the employee knows how they will be paid and to maintain a paper trail of the transactions. We always recommend direct deposit for the accuracy and speed at which an employee is paid.

You can pay your employees on a reasonable, consistent schedule so long as they are aware of it before being hired. Employees often like being paid more frequently but there is less bookkeeping and fewer transactions the less frequent the pay schedule is. We usually recommend weekly, bi-weekly, semi-monthly, or monthly as they are easiest for employees to understand. Take into consideration any banking or processing fees along with your business cash flow when deciding a pay schedule.

Paying Taxes and Filing Tax Information

Paying payroll taxes seems simple: pay the correct amount on time. It’s important to know that each tax type can have a different due date depending on its type, the amount, or even the wage amount it is based on. You must also file a tax return or special forms regularly to ensure the payments made were calculated correctly.

Federal withholding, Social Security tax, Medicare tax, Employer Social Security tax, Employer Medicare tax. These 5 amounts are always paid and reported together. If your total amount for the year will be less than a limit (currently $1,000), you are allowed to file form 944, due January 31st following the year being reported. However, it can be hard to predict the future and you are not provided a lot of wiggle room. Most employers will opt to always file on a form 941 instead. Form 941s are due April 30th, July 31st, October 31st, and January 31st and detail the previous quarter. For example, January through March would be detailed on the April 30th return. Your payment schedule is determined by the following:

Pay when you file your return if your tax liabilities are less than $2,500 annually.

Deposit your taxes by the same day the form 941 is due if your tax liabilities are $2,500 or more for the year (but less than $2,500 for the quarter).

Deposit monthly if your tax liabilities are $2,500 or more for the quarter and you reported equal to or less than $50,000 in these taxes during the most recent July 1st through June 30th period. Payments are due the 15th of the following month.

Deposit semi-weekly if your tax liabilities are $2,500 or more for the quarter and you reported more than $50,000 in these taxes during the most recent July 1st through June 30th period. Deposits are due Wednesday (if your pay date is on Wednesday, Thursday, or Friday) or Friday (if your pay date is on any other day).

Federal unemployment. The form 940 tax return and the payments are due on January 31st following the year being reported. If the balance of the amount due ever exceeds $500, payments are instead due quarterly with the same due dates as the 941 filings. If the business ever expects to come close to $500 in a year, it is safer to pay the amounts quarterly from the beginning.

State liabilities, State unemployment taxes. Each state has its own rules and deadlines. It is best to consult with your accountant to understand your filing and payment requirements (that’s why we are here, after all). The states often follow a monthly or quarterly filing and payment schedule that often aligns with the IRS due dates but exceptions can occur.

W-3s, W-2s. With everything going on, it’s important to remember that W-3s and W-2s must be filed and sent to employees by January 31st of the following year. States may also require their own versions be filed to them. Even if your business has closed, you and the company are legally responsible for filing these and the other forms when due, even if the amounts are zero.

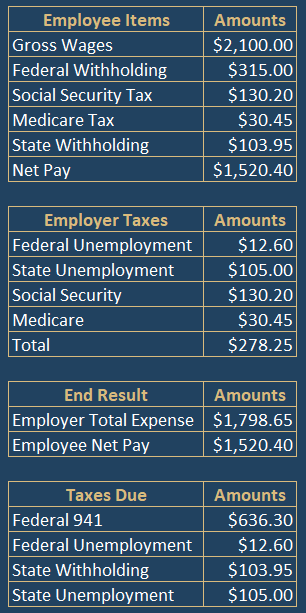

Simple Payroll Example

Whether you read through everything or skipped straight to this example, we commend you for wanting to learn more about payroll. It’s an expensive part of your business and educating yourself on any factor of your business will benefit you. Below is an example of an employee being paid $2,100.00.

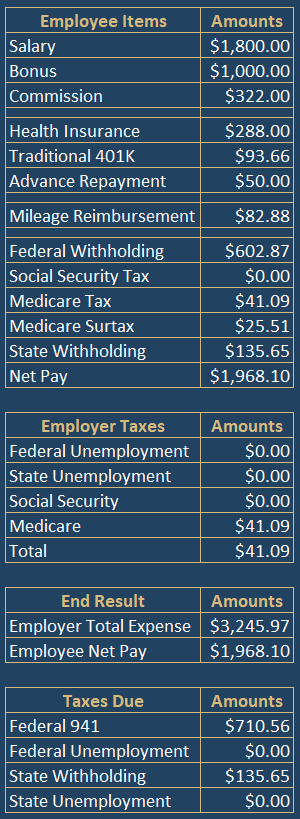

Advanced Payroll Example

In this example, an employee has received a number of different pay types, deductions that have different tax requirements, and a reimbursement. Additionally, the individual has already reached the Medicare surtax amount (and has therefore reached the Social Security and Unemployment tax limits).

Congratulations, you survived learning the basics of payroll!

We would love to help your business by providing our expert services in accounting, payroll, and tax. Contact us today to set up a free consultation.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Level Books assumes no liability for actions taken in reliance upon the information contained herein.